A new co-working space is slated to open in Alexandria in April 2020. The new community to be called The Loop will be located at 215 North Payne Street, the former location of Chec Soda & Refrigeration Co complex.

Continue reading

Property values in Arlington continuing to rise in both the residential and commercial sectors.

Continue reading

Continue reading

The Alexandria based US Senate Federal Credit Union is moving its headquarters in Alexandria. The new building which is located at 1310 Braddock Place is walking distance from the Braddock Metro Station. The building will occupy the former home of the National Industries for the Blind.

Continue reading

Alexandria's West End will be the home of the new Silver Diner which will be opened in Summer 2020. The new establishment will be located at the corner of King Street and N. Beauregard Street.

Continue reading

The City of Alexandria is expected to welcome a new hotel in March 2020. The new Hyatt Centric Hotel described as a pet friendly "boutique" hotel is located at 1611 King Street. The hotel feature 124 rooms, fitness center and a restaurant on site. The hotel will be near the King Street Metro and just down the street from the Hilton Alexandria Old Town and the Wyndham. Rates for opening nights range from $184 to $284.

https://alexandrialivingmagazine.com/news/new-hyatt-centric-hotel-to-open-in-march-2020/

Continue reading

Alexandria's Robinson Landing warehouse building located at 10 Duke Street will be renovated to operate a market and a restaurant. The project which will be undertaken by custom builder Murray Bonnitt will feature a a market with coffee, pastries, prepared foods, beer and wine along with a casual restaurant on the first floor. With the addition of this new restaurant Robinson Landing will now feature two of Alexandria's top restaurant developers.

Continue reading

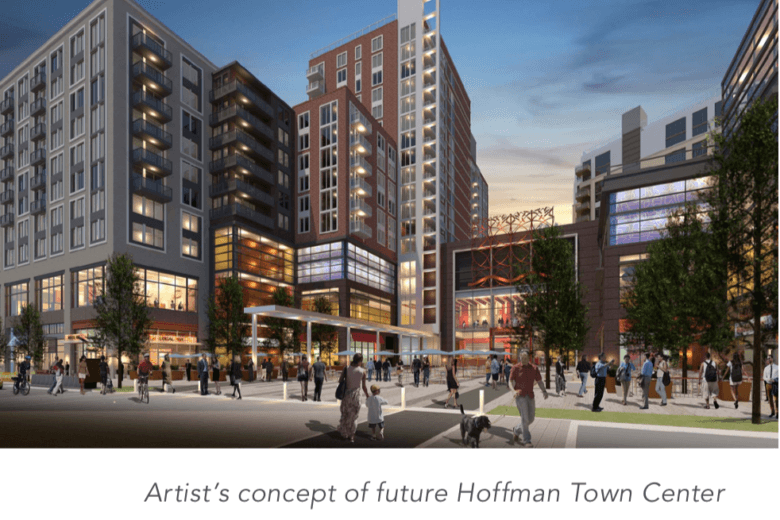

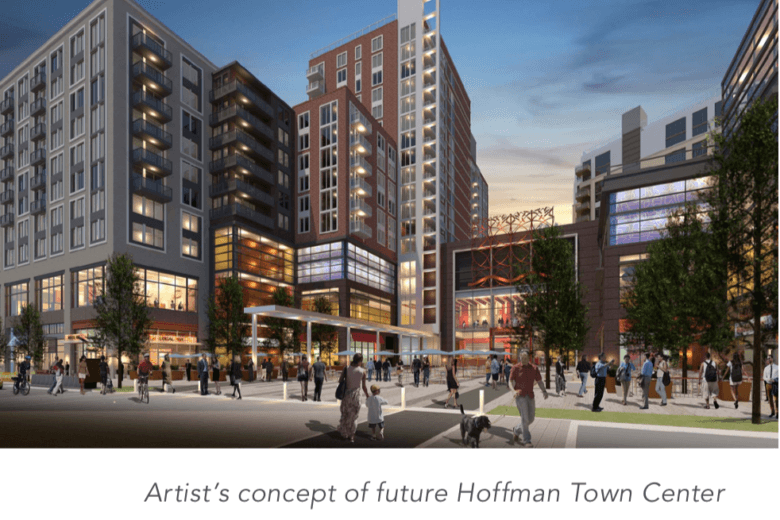

The Washington Metropolitan Area Transit Authority known as Metro is seeking to reduce its office buildings from ten (10) to four (4) with the proposal of a new regional headquarters to be located in Alexandria. The new building will be built on land already owned by Metro. The new headquarters in Alexandria will be located at 2395 Mill Road which is adjacent to the Hoffman Town Center Development and closely located to the Eisenhower Avenue Station.

Continue reading

Yields on U.S. commercial real estate are nearing a record high compared to Treasury bonds. Many investors take that as a signal to buy property.

Capitalization rates, a measure of real estate yields, averaged 7.22 percent in the second quarter, as calculated by the National Council of Real Estate Investment Fiduciaries. That was 4.29 percentage points higher than the yield on 10-year government bonds as of June 30 and 4.75 percentage points higher than Treasury yields as of Aug. 31.

These returns are near the record 5.39 percentage points in the first quarter of 2009, when the U.S. was dealing with the worst economic downturn since the Great Depression. The spread shrank to less than 80 basis points when commercial real estate prices peaked in 2007.

“The data indicate that real estate is poised for a rebound,” says Gerardo Lietz, who advises pension funds on property investments.

Source: Bloomberg, Hui-yong Yu (09/01/2010)

Alexandria's Robinson Landing warehouse building located at 10 Duke Street will be renovated to operate a market and a restaurant. The project which will be undertaken by custom builder Murray Bonnitt will feature a a market with coffee, pastries, prepared foods, beer and wine along with a casual restaurant on the first floor. With the addition of this new restaurant Robinson Landing will now feature two of Alexandria's top restaurant developers.

Alexandria's Robinson Landing warehouse building located at 10 Duke Street will be renovated to operate a market and a restaurant. The project which will be undertaken by custom builder Murray Bonnitt will feature a a market with coffee, pastries, prepared foods, beer and wine along with a casual restaurant on the first floor. With the addition of this new restaurant Robinson Landing will now feature two of Alexandria's top restaurant developers.  The Washington Metropolitan Area Transit Authority known as Metro is seeking to reduce its office buildings from ten (10) to four (4) with the proposal of a new regional headquarters to be located in Alexandria. The new building will be built on land already owned by Metro. The new headquarters in Alexandria will be located at 2395 Mill Road which is adjacent to the Hoffman Town Center Development and closely located to the Eisenhower Avenue Station.

The Washington Metropolitan Area Transit Authority known as Metro is seeking to reduce its office buildings from ten (10) to four (4) with the proposal of a new regional headquarters to be located in Alexandria. The new building will be built on land already owned by Metro. The new headquarters in Alexandria will be located at 2395 Mill Road which is adjacent to the Hoffman Town Center Development and closely located to the Eisenhower Avenue Station.